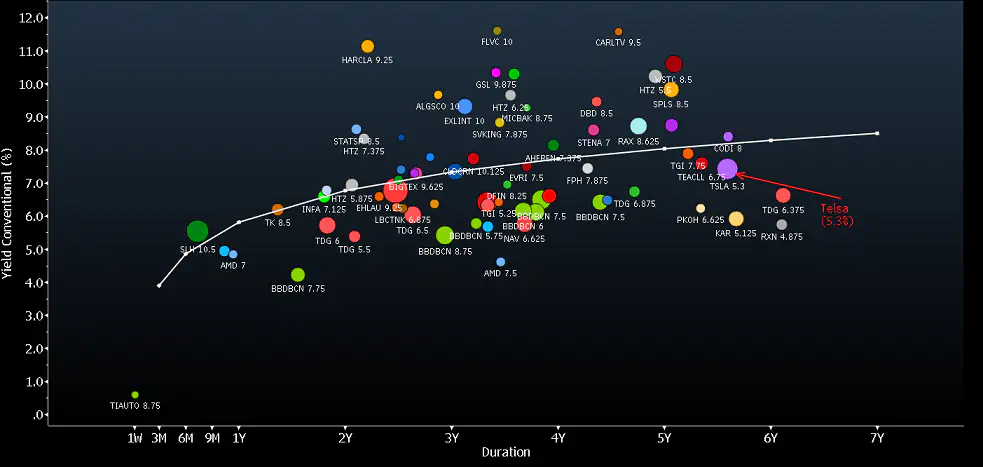

Chart of the Day: Valuing Telsa Through Credit

Tesla’s 5.3% bonds due in 2025 would be five or six percentage points wider if they traded along regression of B3 and Caa1 rated automotive and industrial bonds, which is worse than the base-case scenario of two or three points wider using a 33% chance the bonds get downgraded by S&P. Technicals have been supported by active buying from T Rowe Price in 1Q, which combined with Franklin Resources owns about 28% of the total issue.

BlueLine rental’s 9.25% bonds due in 2024 trade about 70 bps wider than the Tesla notes, and its risk profile likely will benefit further from strong demand, and the potential exit from Platinum Equity. An IPO, based off its recent S-1 filing, or sale to a strategic buyer, could drive favorable event risk.